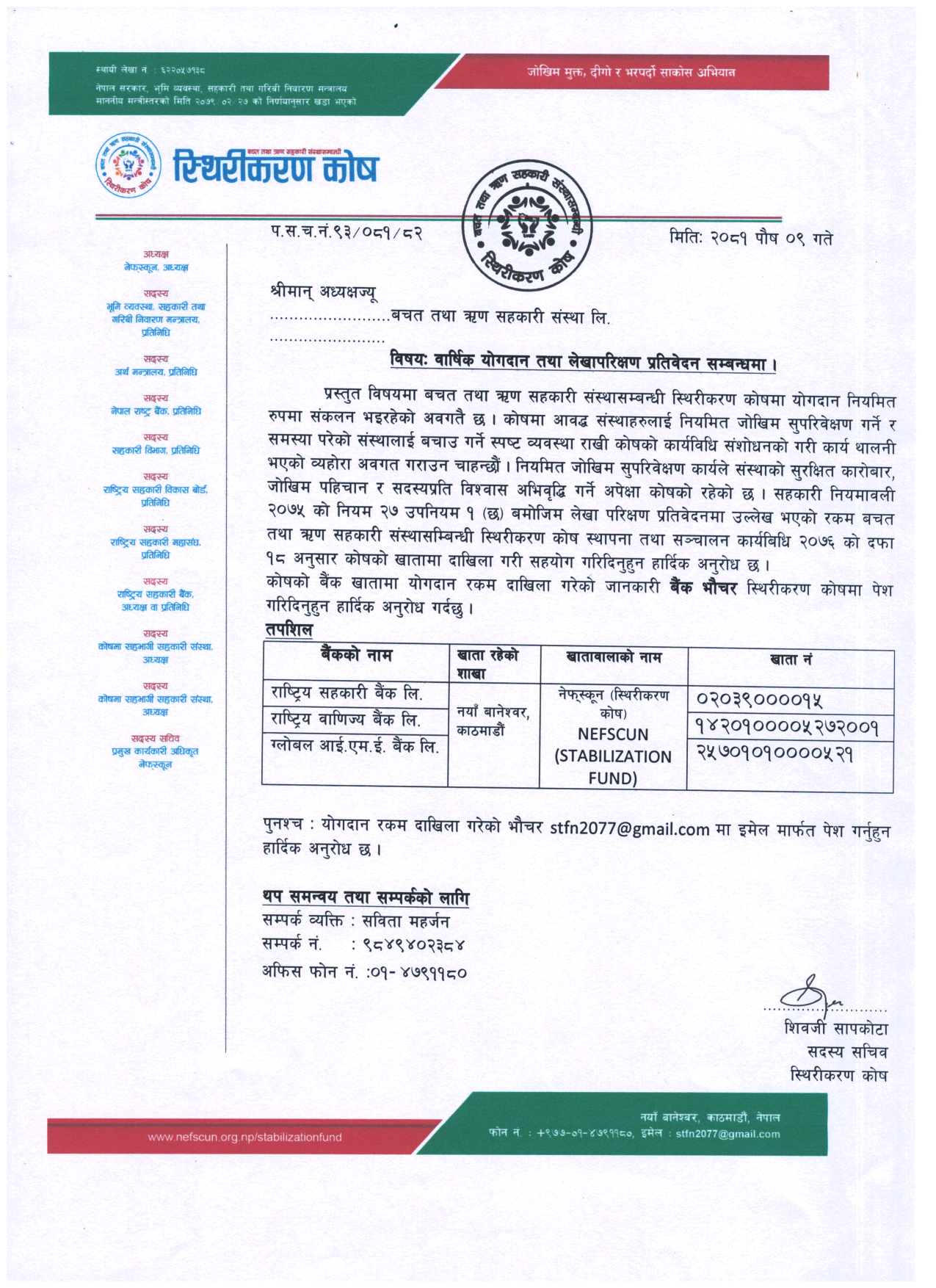

Stabilization Fund

The Stabilization Fund is a reserve fund of the financial cooperative’s movement. This fund is also considered a safety net for the financial cooperative movement. It is a fund set up by financial cooperatives in collaboration with a fund to meet future risks and challenges to reducing future economic disasters.

Introduction

The Stabilization Fund is a reserve fund of the financial cooperative’s movement. This fund is also considered a safety net for the financial cooperative movement. It is a fund set up by financial cooperatives in collaboration with a fund to meet future risks and challenges to reducing future economic disasters. The concept of a stabilization fund has been developed from the concept that it can prevent economic disasters in such cooperative societies by making a small contribution to future risk from today. The Fund was created to create a reserve of liquidity with the additional benefit of reducing inflationary pressure and insulating the economy of Nepal from the volatility of raw material export earnings, which was among the reasons for the financial crisis. To prevent high inflation rates the fund is invested abroad only. The main objective of establishing a stabilization fund for financial cooperatives is to protect the institutions from possible risks. In which the cooperative society can get the required liquidity loan, liability payment loan, and restoration expenses on the basis of contribution if required.

Minimum Requirements to Enroll in SACCOS Stabilization Fund

- Conducted Auditing regularly within the stipulated time.

- Start operations for at least five fiscal years and regular in operation.

- Concluding the annual general meeting of the previous two years within the stipulated time,

- Loan classification and maintain necessary loan loss provision,

- Institutional capital with a minimum of five percent of total assets,

- Is In the previous two financial years, there was no loss and no accumulated loss,

- Not at high risk as per integrated norms by the Ministry,

- Not being on the regulatory body’s watch list at the time of filing the application or not being listed in the quick fix action,

- Included in the integrated management information system approved by the department.